Investing for Beginners: How to Grow Your Money the Smart and Easy Way

Have you ever wondered why so many people invest?

Now, imagine yourself creating additional income stream. i.e. your money is busy making more money for you so that in few years to come, you’d have a LOT more money than you would have if you haven’t chosen to invest your money.

Isn’t that interesting?

Well, people would want to invest for so many reasons – mostly for greater financial security in the future.

So, if you are looking to set yourself up for greater financial security in the future, then you have to set aside some of your money now in investments that could appreciate over time.

As a beginner, it can be hard to know where – and how – to get started with investing. But not to worry. This investing for beginners guide will help you to…

|

Before you get started with any type of investment, it’s important to devote some time to learn some basic concepts about investment.

Below are some few questions about investing for beginners you need to know to get started.

Investment for beginners: FAQs

1. What is an investment?

Ever heard the saying “It takes money to make money?”

Well, one way to make money from money is to put your money to work. That’s right! Your money can work for you even when you sleep.

Founder of GoDaddy, Bob Parsons rightly puts it:

I learned that, if you want to make money, you’ve got to make it when you sleep. – Bob Parsons.

| Investing is the act of putting out money or capital with the expectation of obtaining more money in the future. It is a means of making additional income. |

Investing could be likening to planting, you take out some of your hard-earned money and invest (plant) for your future needs.

This is a way to make the most of your earning – in fact, Investing is a means to a happier ending.

[bctt tweet=”Investing is: Putting your money to work to make more money.” username=”ansa_careers”]

| It should be noted here that; the aim of investing is to plant your money in hopes of growing it over time. It is not gambling, where you try to pursuit a quick payout.

So, investing for beginners requires prioritizing your financial futures over your present desires. |

2. Why should you invest?

To answer for short: is to create wealth. Warren Buffet is a legendary example.

Investing can help you secure your future and reach your financial goals. For example, paying for your children’s education, passing wealth to loved ones, or building a nest egg for your own retirement

Did you know?

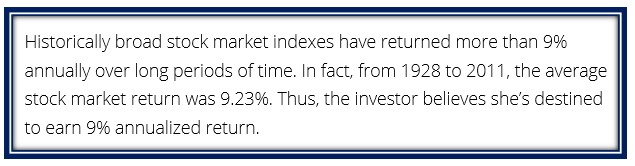

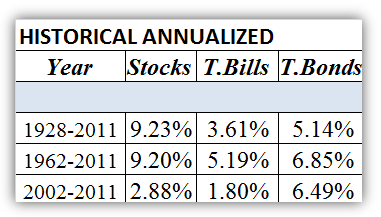

According to Barbara Friedberg:

Stock investments have historically returned more than 9% per year, on average. Imagine if you invest say, $10,000 at this return rate for 40 years, it would grow to nearly $315,000.

- Here are some other potential reasons to invest money

3. Is your Investment Safe?

The biggest risk is not taking any risk… In a world that changing really quickly, the only strategy that is guaranteed to fail is not taking risks. – Mark Zuckerberg

People often don’t consider the impact of inflation when deciding what counts as “safe investment”. If the inflation rate is higher than the interest rate that your investment pays, you’re guaranteed to lose money.

So, investment in stock market isn’t entirely safe. The safest approach is to save more money than you need, so that you can afford to weather both inflation and stock market dips.

Whether you choose a higher-risk, higher-return investment strategy or a lower-risk, lower-return strategy, you should remember that investment risk depend partly on your investing time frame.

[bctt tweet=”The biggest risk is not taking any risk…” username=”ansa_careers”]

Safer investments offer lower returns while the higher risk investments typically offer higher returns.

The rule is, the higher the interest, the higher the risk, so take care when choosing which bonds to invest in and pay attention to the bond’s coupon (interest rate).

| Investment Tips: the farther you are from retirement, the more risk you can afford to take. By the same logic, the closer you are to retirement, the more you likely want to focus on preserving your gains and avoiding too much risk. |

4. How much should you invest for a start?

Anyone can invest and for as little as $100 per month. Investment experts generally suggest that you should aim to invest at least 10% of your income.

Do not save what is left after spending, but spend what is left after saving. — Warren Buffet.

The most important thing is that you start your investment now no matter how small and make it a habit. You may be surprised at the long-term impact you can make by investing a seemingly small amount of money while you’re young.

The habit of regularly investing even small amounts of money is definitely a habit worth cultivating, a habit that will pay off handsomely for you.

Still want to know more?

Read: 10 key investing questions and answers from experts.

Now that you have a general idea of what investing is and why you should do it, it’s time to learn about the different types of investment to make confident investment decisions.

The basic types of investing for beginners

There are many types of investments you can make. Mutual funds, ETFs, individual stocks and bonds, real estate, various alternative investments and owning all or part of a business are just a few examples.

Understanding how these different types of investment work is critical to your success, as this is the building blocks of investing for beginners.

Below are some basic types of investment you can start with.

i. Stocks

This investment type is also known as equities. They are the most well-known and conventional type of investment. Stocks are simply a stake in a company, which will often pay its shareholders a regular dividend.

That is to say, if you Invest in Stocks, you have partial ownership (have a claim on the company’s assets in the event of liquidation, but do not own the assets.) of the company you’re investing in.

So, you benefit from any profit, income or gains enjoyed by that company and vice versa.

Though Stocks tend to be more risky than other investments, they have high return potential over long time periods.

There is a wealth of freely available information online for stock traders at websites such as Morningstar.com, Yahoo Finance, and Zack’s Finance.

ii. Bonds:

Investing in bonds is another smart way to to invest for beginners. Bonds are fixed-income investments, whereby an investor loans money to a company or agency in exchange for periodic interest payments when the bond matures.

Unlike Stocks, bonds are generally less risky, but with lower return potential.

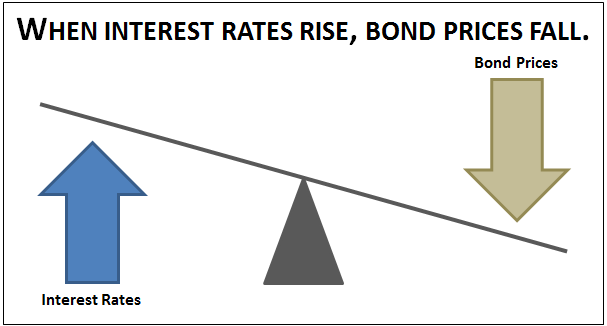

Bonds are designed to create a steady stream of income. It’s value can fluctuates, based on several factors, the most important being the direction of interest rates.

For example, bond prices move inversely with the direction of interest rates as demonstrated in the diagram below.

To learn more about investing in bonds you can access helpful educational resources at Bankrate.com.

iii. Mutual funds

This type of investment allows investors to have their money invested in stocks, bonds or other investment which are managed by an investment manager.

Mutual funds are a great way for investors large and small to achieve a level of instant diversification.

Alternative investments for beginners

Beyond stocks, bonds and mutual funds, there are many other ways to invest. For example, you could invest in Commodities, Forex, real estate and many others.

Below are the safest and most profitable alternative ways to invest for beginners:

a. Property:

Investments in property could be in a home (like real estate) or owning commercial property like shops, hospitals or factories.

You can also buy shares in property-related companies.

Commodities are physical substances that are mined or grown such as gold, silver or oil or even grain and coffee.

b. Peer-to-peer lending

Investments in peer-to-peer lending means you lend money to people or “peers” through peer-to-peer companies. The people you lend money to, pay back the loans with various interest rates.

This type of investment is relatively safe and you can get started with less funds.

One benefits of peer-to-peer lending is the fact that it minimizes risk through spreading out investments over many borrowers. This means, your funds are spread out to many borrowers rather than placing it to one borrower. This compensate for any of those who fail to make their payments.

To get started with this type of investment, simply visit one of the many peer-to-peer lending company websites such as Prosper, Lending Club, and Peerform.

Ready to Invest? Let’s Get Started

I believe you’re now ready to get started with your investment. Here are some ideas on how to proceed right now:

First, you should think about your financial goal. We all have goals that need financing. Depending on your financial goals, you might want to start off with less funds.

Ask yourself:

What are your reasons for investing? What is your timescale? And how much money will you need to achieve this goal?

Then you need to think about your own tolerance to risk.

Next you need to decide what type of investment you think will fit your attitude to risk, while still being likely to achieve your goal.

Consult an expert: Find out your options. Speak to an investment advisor at your bank for example, about whether you should open up a tax-free savings account (TFSA) or invest in your registered retirement savings plan (RRSP).

Once you understand all the different types of accounts, the pros and cons, then you’re more educated to make those appropriate decisions.”

Conclusion

One of the basic principles of investing for beginners is this – risk and opportunity go hand in hand. They increase or decrease in conjunction with each other.

Investments that offer higher potential profit carry correspondingly higher levels of risk. Likewise, investments that offer lower potential return on investment (ROI) typically offer greater security, less risk.

Because of the correlation between risk and potential return, investors need to carefully consider their risk tolerance when selecting investments – how much risk you’re willing to accept in return for the opportunity to realize “X” amount of profit.

It’s also important to think about your personal investment goals, the reason for your investment choices.

An investor who is looking to generate a second income through investing, or amass a large enough fortune to retire on, will make much different investment choices than an investor who is merely seeking to earn a little interest to help offset inflation and protect his or her purchasing power.

More helpful resources

This has been a guide to investing for beginners and I hope you’ve found it helpful. To keep advancing your knowledge about investing, check out these helpful resources below:

- The Only Investment Guide You’ll Ever Need

- Investments: An Introduction (with Stock-Trak Coupon)

- The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel

- Financial Risk Management For Dummies

- How ChatGPT Can Help You Excel in Your Chosen Career - October 19, 2023

- International Nurse Practitioner: A Growing Profession - April 18, 2019

- Most Important Factors to Consider In choosing A Career Path - March 8, 2019